YC vs Techstars: Which Accelerator is Right for Your Startup?

YC vs Techstar, Which Accelerator is the Best Fit for Your Startup's Growth and Funding Needs?

If you're an early-stage startup founder, joining an accelerator like Y Combinator (YC) or Techstars can significantly boost your chances of success. These programs offer funding, mentorship, and invaluable networking opportunities that can help take your business to the next level.

But before you apply, it’s essential to understand the terms of investment each accelerator offers. The terms vary significantly between YC and Techstars, and making the right choice could impact both your financial future and control over your company.

This post breaks down the key differences in cash offers, equity structures, and other factors to help you make an informed decision.

For more insights on securing your initial funding, check out our guide on How to Raise Your First Round.

Investment and Equity Structure Comparison

🟠 YC Cash Offer

Y Combinator offers $500,000 in total funding:

- $125,000 for 7% equity, valuing your company at approximately $1.79 million post-money.

- $375,000 as an uncapped SAFE with a Most Favored Nation (MFN) clause.

🟢 Techstars Cash Offer

Techstars offers $220,000 in total funding:

- $20,000 for 5% equity.

- $200,000 as an uncapped SAFE with MFN.

YC gives you more upfront cash but in exchange for a higher equity stake. Techstars offers a lower cash amount but with less equity dilution upfront, allowing you to retain more control.

Dilution and SAFE Impact

The $375,000 SAFE from YC will result in more dilution at the next funding round compared to Techstars’ $200,000 SAFE. While YC’s higher funding allows you to scale faster, the additional dilution could impact your ownership in future rounds. On the other hand, Techstars’ smaller SAFE translates to less dilution, allowing you to maintain a larger portion of your company.

If your priority is retaining more ownership early on, Techstars may be a better choice. However, if you need more capital upfront to grow quickly, YC’s offer might be worth considering despite the additional dilution later.

💡More Resources: How To Find Investor For Your Startup

Network Strength and Reach

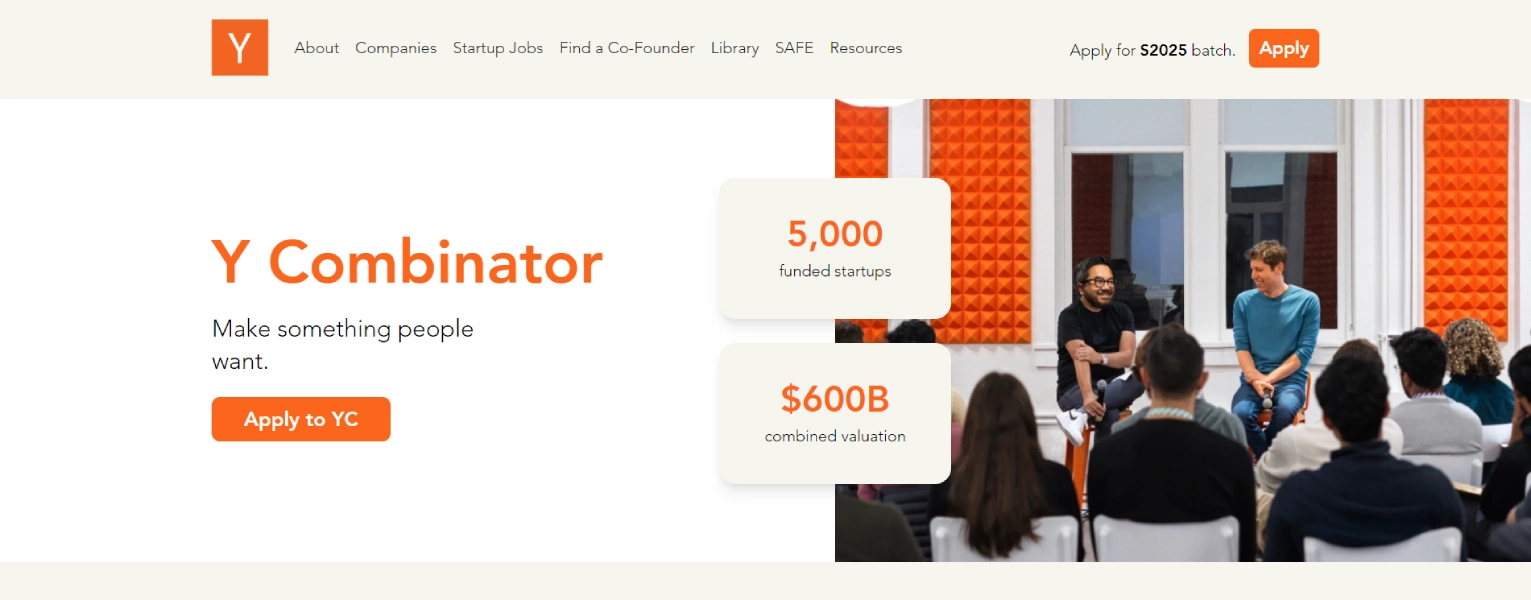

🟠 Y Combinator (YC)

YC has one of the most influential startup networks globally, with alumni including Airbnb, Stripe, and Dropbox.

The extensive YC network connects founders with top-tier investors, mentors, and industry experts. This network can be a key advantage for fundraising, as many top investors actively look for YC-backed companies.

Additionally, YC’s vast alumni base opens up opportunities for strategic partnerships and enhances brand recognition, helping your company gain credibility quickly in the market.

🟢 Techstars

Techstars also has a strong alumni network, featuring companies like SendGrid, Chainalysis, and Zipline.

While smaller than YC's, Techstars offers access to over 50 global accelerator programs, providing a more intimate, hands-on approach. The network is focused on mentorship, offering valuable insights and introductions that can support fundraising and help with business development.

Techstars alumni often share specific, actionable advice, helping your company grow within your niche.

Duration and Other Benefits

Both Y Combinator and Techstars have accelerator programs that last 3 months, providing intense, focused support for startups. However, the type of support you receive differs between the two.

🟠 YC is known for its strong brand recognition and fundraising tools. As a YC startup, you immediately gain credibility, which can be a major advantage when raising future funding rounds. YC also provides a suite of tools tailored to helping startups scale quickly, along with access to an impressive roster of investors.

🟢 Techstars, on the other hand, offers a more mentor-focused approach, providing access to a dedicated mentor network and alumni support. The program’s emphasis is on hands-on guidance, making it ideal if you value close mentorship and personal connections within a highly engaged community.

Get access to curated lists of VCs, angels, and accelerators, available exclusively to Evalyze.ai Pro and Enterprise users, to help kickstart your fundraising.

Ideal Founder Fit

🟠 YC is best for founders who are looking for a larger upfront cash injection and are willing to give up more equity in exchange for access to YC's high-profile network and strong fundraising tools. It’s a great fit for ambitious founders who need significant resources to scale quickly and don’t mind higher dilution.

🟢 Techstars might be more appealing for founders who prioritize lower dilution, a simpler structure, and personalized mentorship. Techstars offers a more balanced approach with global reach and dedicated mentorship from industry experts if you're looking for strong support without giving up as much equity upfront.

Conclusion

Choosing between Y Combinator and Techstars depends on your startup's specific needs. YC is ideal for founders who want higher upfront cash and are willing to give up more equity for rapid scaling. Techstars is a better fit if you prefer lower dilution and value personalized mentorship.

Use Evalyze to improve your chances in either accelerator. Evalyze.ai is an AI-powered platform that can refine your pitch deck by providing an Investor Readiness Score, actionable feedback, and critical gap analysis.

With competitor benchmarking against over 8,000 YC startups, Evalyze helps ensure your deck stands out to investors.

More Articles

What is a Pitch Deck? Essential keys to success

A pitch deck is a visual presentation that helps businesses communicate their vision, strategy, and growth potential to investors and partners, aiming to secure funding or support.

October 1, 2024

15 Company’s pitch decks raised millions of dollars + Pitch Deck ppts Links

Evaluating a company's pitch deck is a critical part of assessing its potential for raising capital and long-term success. This blog post of Evalyze.ai will showcase 15 standout companies whose pitch decks helped secure millions of dollars in funding, fueling their growth and market impact. From innovative tech platforms to sustainable brands, each of these companies used a compelling pitch to connect with investors. We also provide downloadable links to their pitch decks, giving you a behind-the-scenes look at what it takes to create a winning presentation for potential backers.

December 23, 2024