How Venture Capitalists Really Think

A no-fluff breakdown of how venture capital really works—and what founders must know to win it

Venture capital looks like a fast track to funding, but it comes with high expectations. VCs aren’t looking for solid businesses—they’re looking for outliers that can return 10x or more.

Most founders don’t realize this. They pitch a good product or steady growth, but that’s not enough. To raise VC money, you need to understand how VCs think—and that starts with the math.

This guide explains how VC funds work, where the money goes, and why VCs chase unicorns. It’s not just about pitching well—it’s about knowing what they actually need to win.

🔑 Key Takeaways

- VCs aren’t looking for steady wins—they need one or two big ones to make the fund work.

- Out of a $100M fund, only $80M goes into startups; the rest covers costs.

- To satisfy investors, the fund must return around $310M—small exits won’t get there.

- Founders who understand this math pitch differently: they show how they can become a breakout success.

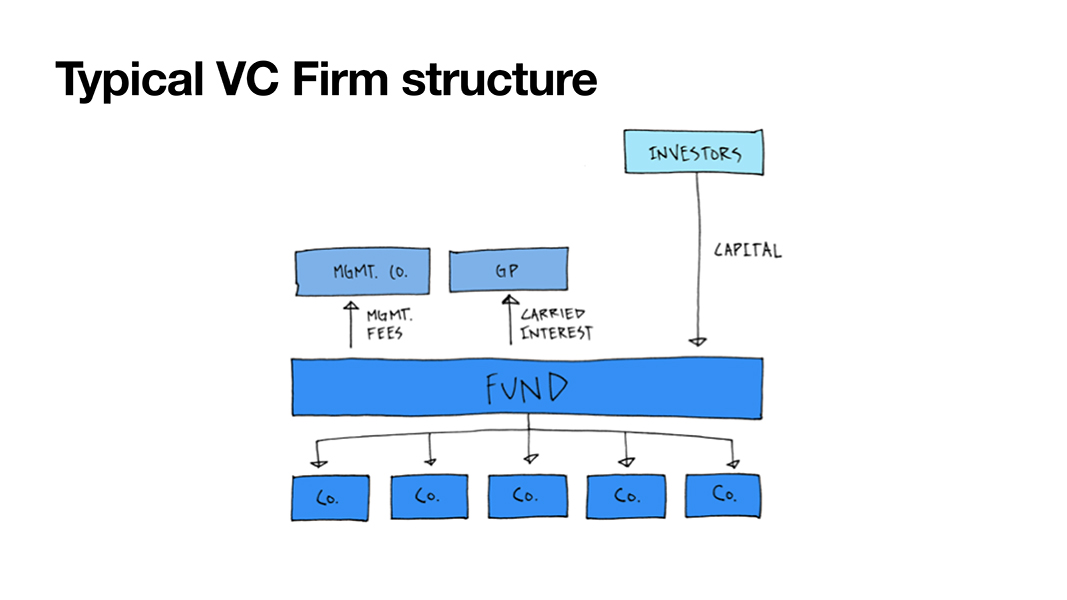

The VC Firm Structure: Who’s Behind the Money?

Limited Partners (LPs) and General Partners (GPs) are the leading players.

Limited Partners (LPs): The Financial Backers

Imagine you're launching a startup and need substantial capital. The funds you seek often originate from LPs. These are typically:

- Pension Funds: Organizations managing retirement funds, aiming for growth through diverse investments.

- Family Offices: Private entities managing wealth for high-net-worth families, looking to invest in promising ventures.

- Endowments and Foundations: Institutions investing to support their long-term missions.

LPs allocate their capital across various assets—stocks, bonds, real estate, and venture capital. Venture capital is high-risk but offers the potential for significant returns. Typically, LPs might dedicate about 2-5% of their investment portfolio to VC funds.

General Partners (GPs): The Investment Managers

GPs are the individuals or entities responsible for managing the VC fund's operations and investment decisions. Their roles include:

- Investment Decisions: Identifying and investing in startups with high growth potential.

- Fund Management: Overseeing the fund's day-to-day activities, including operations and compliance.

- Investor Relations: Communicating with LPs about fund performance and future strategies.

GPs receive a management fee, typically around 2% of the fund's committed capital, to cover operational costs. Additionally, they earn a percentage of the fund's profits, known as "carried interest," usually about 20%, aligning their interests with those of the LPs.

💡Free Resource: How To Find Investor For Your Startup

The 2-20 Rule

When a VC firm raises a $100 million fund, they don’t actually invest all of it in startups.

Here’s what happens:

- 2% per year goes to running the firm — salaries, rent, travel, everything. Over 10 years, that’s $20 million.

- That leaves $80 million to invest in companies.

But the big money for VC managers (called GPs) doesn’t come from salaries. It comes from "carry" — their share of the profits. But they don’t earn this unless they beat a high bar.

What’s that bar?

The investors (called LPs) expect around 12% annual returns. Unless the VC fund grows their money at that pace or better, the GPs earn nothing extra.

In short:

- GPs only win big if their startups perform exceptionally well.

- The pressure is on — because average returns don’t cut it.

💡Free Resource: Essential VC Resources from Pre-Seed to Seed Stage

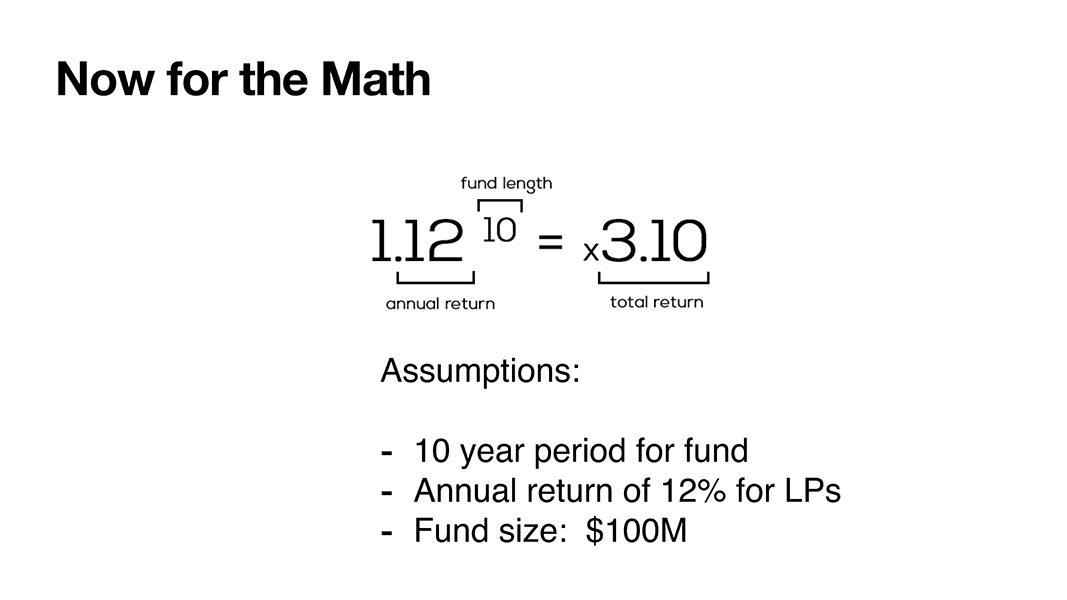

The VC Math: Returns Required

If a VC firm raises a $100 million fund, its investors (LPs) expect to get back around $310 million after 10 years. Why so much? Because they want around 12% annual returns, and that compoundes over time.

Here’s how the math plays out:

- The fund invests in 10 startups, putting $8 million into each.

- Why not $10 million per company? Because $20 million of the fund is used for management fees (remember the 2-and-20 rule).

- At the time of exit, the VC typically owns 25% of each startup.

So, for each investment to help hit the target, it needs to exit big—and a few need to exit really big. Small wins or break-even outcomes won’t get the fund to $310 million.

💡Free Resource: 9 Winning Startup Pitch Decks and Why They Secured Funding

Why VCs Need Unicorns

Let’s say a VC firm makes 10 equal investments and ends up owning 25% of each company at exit. To meet investor expectations, they need to return $310 million.

Here’s what different outcomes look like:

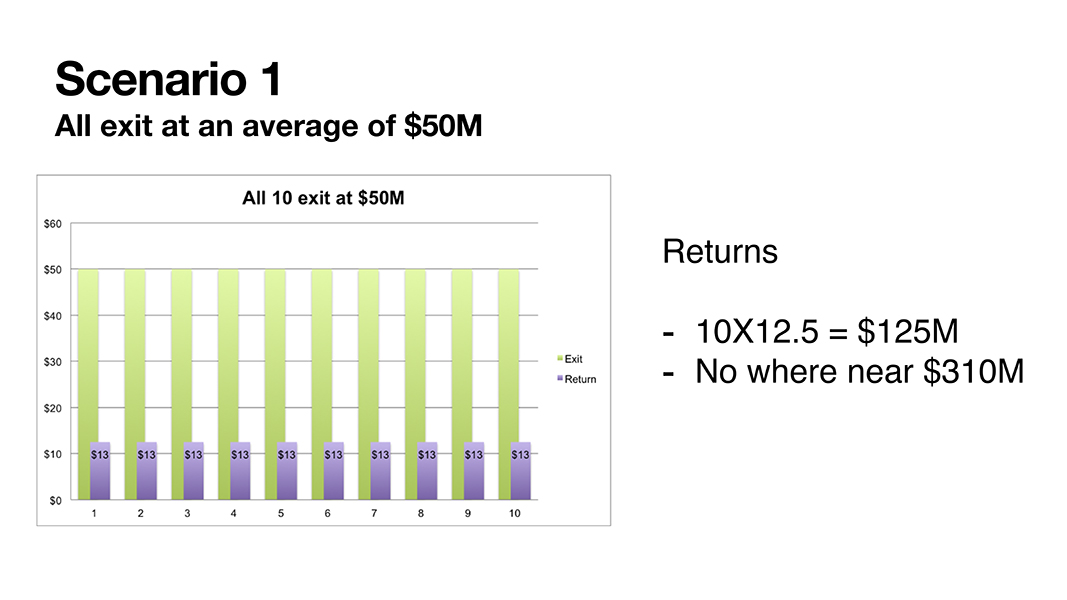

- Scenario 1: All 10 companies exit at $50 million

→ The fund makes $125 million. That’s not even halfway to the goal.

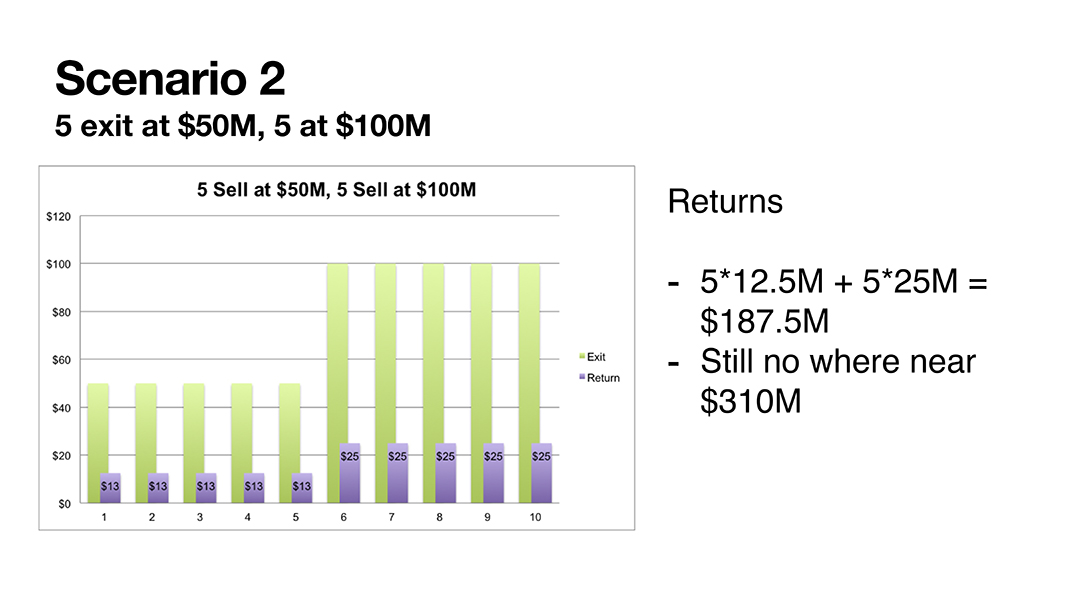

- Scenario 2: 5 companies exit at $50M, 5 at $100M

→ The return is $187.5 million. Still way off.

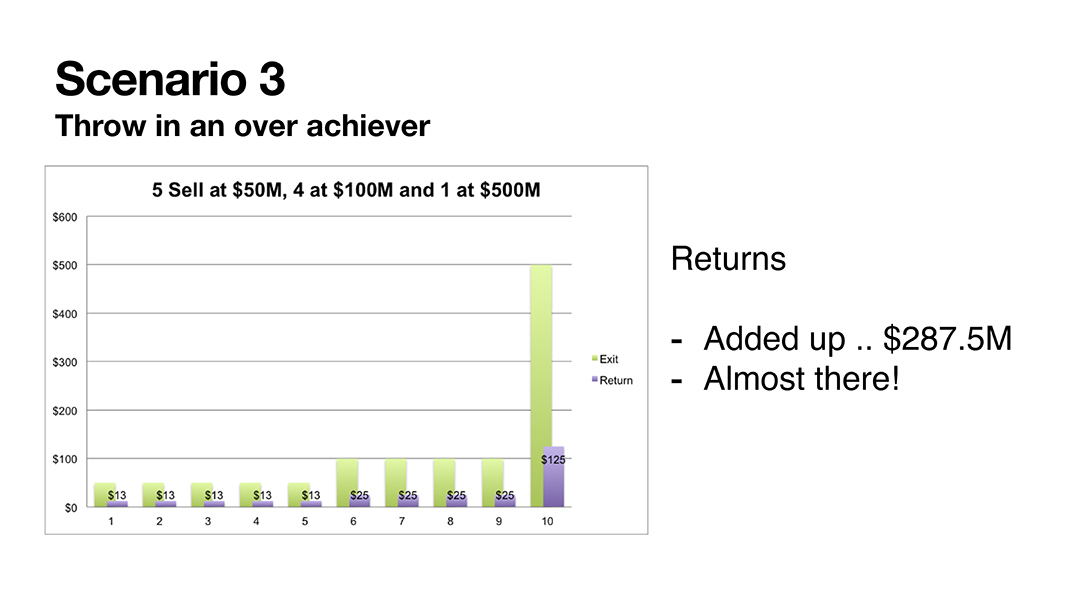

- Scenario 3: Same as Scenario 2, but one company exits bigger

→ Now they hit $287.5 million. Close, but not enough.

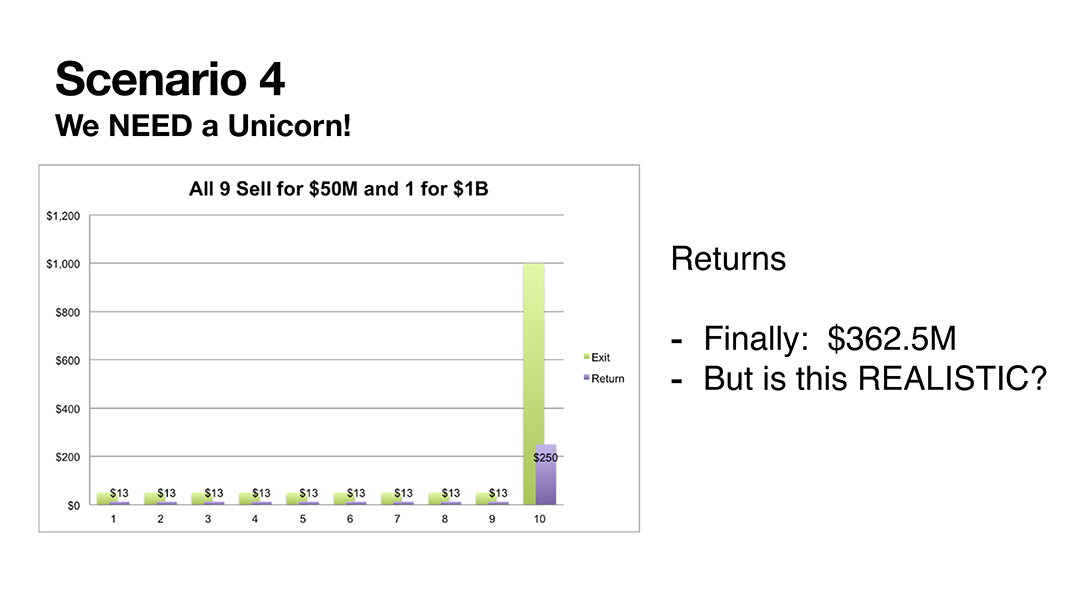

- Scenario 4: Add a unicorn — one company exits at $1 billion

→ The fund returns $362.5 million. Finally beats the target.

A VC fund usually needs at least one massive win to make the numbers work. That’s why VCs pass on “good” startups—they’re chasing the few that can deliver outsized, fund-returning exits.

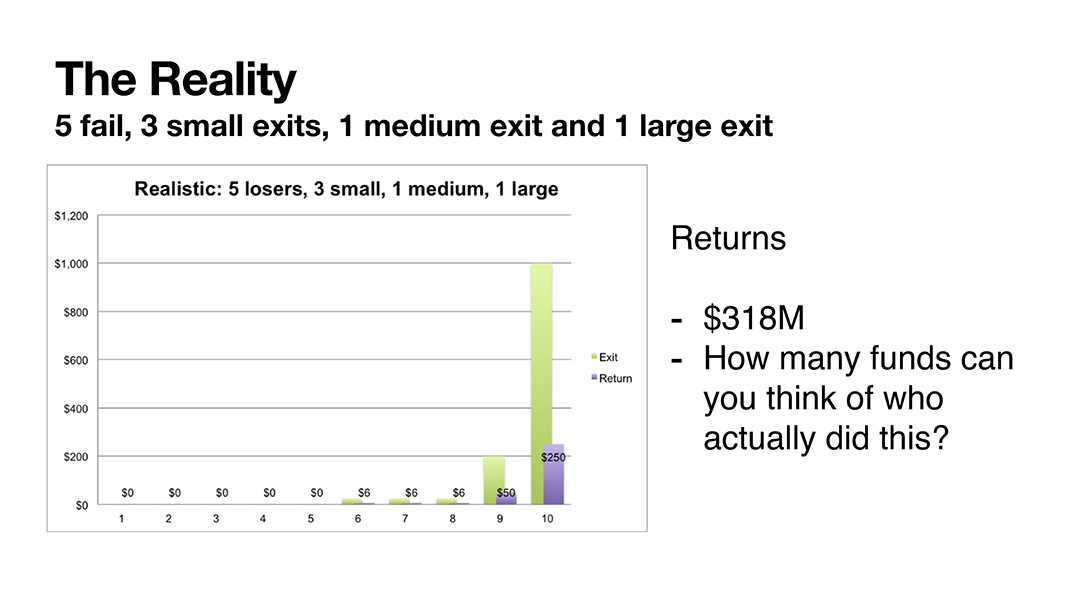

Reality Check: What Usually Happens

Here’s a more realistic outcome for a VC fund:

- 5 companies fail completely

- 3 exit small (returns are modest)

- 1 exits at a medium valuation

- 1 becomes a large success

The total return? Around $318 million.

That just barely clears the target of $310 million needed to satisfy investors.

This is the truth most founders never hear: Even with one big win, most funds only just make it. And very few funds repeat this success over and over.

This is why VCs are extremely selective and often pass on anything that doesn’t have huge upside potential. They're not being difficult—they're doing the math.

How VCs Evaluate Startups: What Reduces Risk

Before writing a check, VCs ask one big question: What could go wrong? They look at four key risks:

- Development Risk – Can the product actually be built?

- Market Risk – Will enough people want it?

- Execution Risk – Can the team deliver?

- Finance Risk – Will the startup run out of money too soon?

To feel confident, VCs look for 5 critical things, often called the 5 Ts:

- Team – Is the team smart, experienced, and able to build and scale?

- TAM (Total Addressable Market) – Is the market big enough to support a billion-dollar business?

- Technology – Is the product scalable, and can it create a real advantage?

- Traction – Are there signs of fast growth, revenue, or user adoption?

- Trenches – What protects the business from copycats? (e.g. brand, tech, network effects)

If a startup checks these boxes, it stands a much better chance of getting VC funding. It's not just about having a good idea—it’s about showing you’ve thought through the risks and have what it takes to win.

💡Must Read: What Are Investors Looking For in Pitch Decks?

Conclusion: Why This Math Matters

If you're a founder raising VC money, you need to know the numbers behind it. VCs aren’t just betting on good companies—they’re betting on companies that can return the entire fund.

That means:

- Average success won’t cut it.

- Small exits don’t move the needle.

- One breakout win can make or break the fund.

When you understand this math, your fundraising strategy changes. You start thinking like an investor:

Can this company be big enough to matter?

If the answer is yes, you’re not just building a company—you’re building a magnet for serious investment.

Role of Evalyze.ai in Navigating VC Expectations

Evalyze.ai helps startups meet VC standards by improving their pitch decks through AI-powered analysis. It provides an Investor Readiness Score along with specific feedback on key areas like market size, business model, and team strength.

By comparing your deck to 8,000+ successful startups, Evalyze.ai shows where you stand—and how to fix it with storytelling. It’s a smart tool to boost your chances of raising capital in a competitive VC landscape.

Start Your Free Analysis Now →

📌 Reference

This blog post is based on insights shared in a LinkedIn post by Rubén Domínguez Ibar and the accompanying resource titled VC Math by Guhesh Ramanathan and Manas Tiwari.

More Articles

Use AI for Fundraising

Artificial intelligence (AI) is transforming fundraising by making it more efficient, precise, and innovative

January 16, 2025

15 Company’s pitch decks raised millions of dollars + Pitch Deck ppts Links

Evaluating a company's pitch deck is a critical part of assessing its potential for raising capital and long-term success. This blog post of Evalyze.ai will showcase 15 standout companies whose pitch decks helped secure millions of dollars in funding, fueling their growth and market impact. From innovative tech platforms to sustainable brands, each of these companies used a compelling pitch to connect with investors. We also provide downloadable links to their pitch decks, giving you a behind-the-scenes look at what it takes to create a winning presentation for potential backers.

December 23, 2024