5 Top Websites to Discover Angel Investor Lists

Discover the best platforms to connect with the right angel investors and accelerate your startup’s growth

Discover the best platforms to connect with the right angel investors and accelerate your startup’s growth.

As a startup founder, you know that the right investor can change everything. But finding those investors? That can be the tricky part. Angel investor lists help take the guesswork out of the equation by giving you access to a curated database of potential backers who are actively seeking opportunities in your industry. These lists save you time, letting you focus on what really matters—building your business.

Rather than casting a wide net, these platforms allow you to filter for specific investor types—whether by industry, geographical location, or investment preferences. The result? You can target the investors who are more likely to be interested in your startup, which means less time spent searching and more time spent connecting with the right people.

In this post, we’ll walk you through some of the top websites that offer angel investor lists, helping you connect with the right backers and move your fundraising efforts forward.

🔑 Key Takeaways

- AngelList and Evalyze.ai databases help founders find aligned investors fast, freeing you to focus on your startup.

- Angel Investment Network and Angel Match let you filter investors by niche, boosting your pitch success.

- Angels Partners and Evalyze.ai offer tools like email templates and AI pitch analysis to streamline fundraising.

- Access global investors with Angel Investment Network or target local ones via Evalyze.ai’s regional lists.

- Angels Partners and AngelList provide communities, syndicates, and pitch tools to support your fundraising journey.

What Are Angel Investor Lists?

Angel investor lists are simply directories or databases that compile the details of angel investors who are actively looking to fund early-stage startups. These lists are valuable tools for founders because they help you quickly identify potential investors who are interested in your business type and industry, saving you time and effort during the fundraising process.

For founders, these lists provide several key benefits:

- Targeted Funding: Instead of randomly reaching out to investors, you can focus on those who have a track record of investing in businesses like yours, increasing your chances of success.

- Faster Connections: Having access to a curated list allows you to connect with investors who are ready to talk and potentially invest, which can speed up your fundraising process.

- Investor Research: Investor lists often include important details about the investor’s interests, investment history, and whether they prefer to fund startups at a specific stage (e.g., seed, Series A). This allows you to personalize your pitch to each investor, increasing the likelihood of making a positive impression.

💡Resources May Help You: Essential VC Resources from Pre-Seed to Seed Stage

How Are Angel Investor Lists Categorized?

- Industry-Specific: Angel investors often specialize in certain industries, such as tech, healthcare, or consumer products. By filtering investor lists by industry, you can find angels who have a vested interest in your startup’s sector.

- Geographical Location: Some investors prefer to invest locally or regionally. This is useful if you’re looking for investors who understand your market and are likely to provide more than just capital, like valuable connections and local expertise.

- Investment Preferences: Investors may also have preferences regarding the stage of a startup they invest in—whether it’s a pre-revenue, early revenue, or scaling company. By using filters based on these preferences, you can focus on investors who are more likely to be interested in your business at its current stage.

💡Things You Need To Know: How Venture Capitalists Really Think

5 Websites to Find Angel Investor Lists

AngelList: Your Hub for Connecting with Investors

Overview:

AngelList is like the ultimate matchmaking platform for startups and investors. Since launching in 2010, it’s helped thousands of founders (maybe even some of your startup heroes!) raise over $3.6 billion by connecting with angel investors and VCs. It’s not just a directory—it’s a vibrant community where you can showcase your startup, network, and close deals, all in one place.

Here’s what makes AngelList stand out:

- Startup Profiles: Create a polished profile that’s like your startup’s digital storefront. Share your vision, traction, and team to grab investors’ attention. Pro tip: A strong teaser (think short, intriguing blurb) can make your profile pop and get you trending on the platform.

- Investor Search Tools: AngelList lets you filter investors by location, industry, or investment stage. Want to find angels who love early-stage fintech in San Francisco? You can narrow it down and message them directly.

- Syndicates: These are like group investments led by experienced angels. Joining a syndicate means you’re not just getting funds but also the expertise and network of a seasoned investor. In 2017, AngelList had 4,400 investors across 165 syndicates—plenty of opportunities to tap into.

- Fundraising Made Easy: Raise funds for free after setting up your profile. You can even use Roll Up Vehicles (RUVs) to streamline investments from multiple angels into a single line on your cap table. Founders rave about how RUVs simplify the process—some call it the “best fintech product ever launched.”

💡Learn To Create: Crafting Seed to Series A Pitch Deck

Angel Investment Network: Your Global Gateway to Investors

Since 2004, Angel Investment Network has been a lifeline for startups, connecting over 1.5 million entrepreneurs with more than 300,000 angel investors across 80+ countries. They’ve raised funds for thousands of businesses, with success stories like Escaping Plan, which revolutionized travel planning thanks to investor connections made here. It’s a vibrant, founder-friendly ecosystem designed to help you find investors who align with off your startup’s industry and goals.

Here’s why Angel Investment Network rocks:

- Powerful Investor Filters: Narrow down your search by investor type, industry, location, or investment size. Looking for angels who specialize in SaaS or healthcare? You can filter for those who focus on your niche, saving you time and boosting your chances of a match.

- Easy Pitch Creation: Their intuitive online form lets you craft a compelling pitch in minutes. No tech headaches—just a clear way to showcase your vision. Founders say it’s “surprisingly easy and fast” to get their pitch in front of investors.

- Global Network, Local Impact: With 35+ regional networks (like USA, UK, India, and Caribbean), you can tap into local expertise or go global. This flexibility is perfect for founders targeting specific markets or casting a wide net.

- Resources for Success: Beyond connections, they offer blogs, fundraising courses, and tips to polish your pitch. Their AI-driven features help your pitch resonate with investors, as seen in stories like Escaping Plan’s transformative fundraising journey.

💡Might Be Useful: YC vs Techstars: Which One is Right for You?

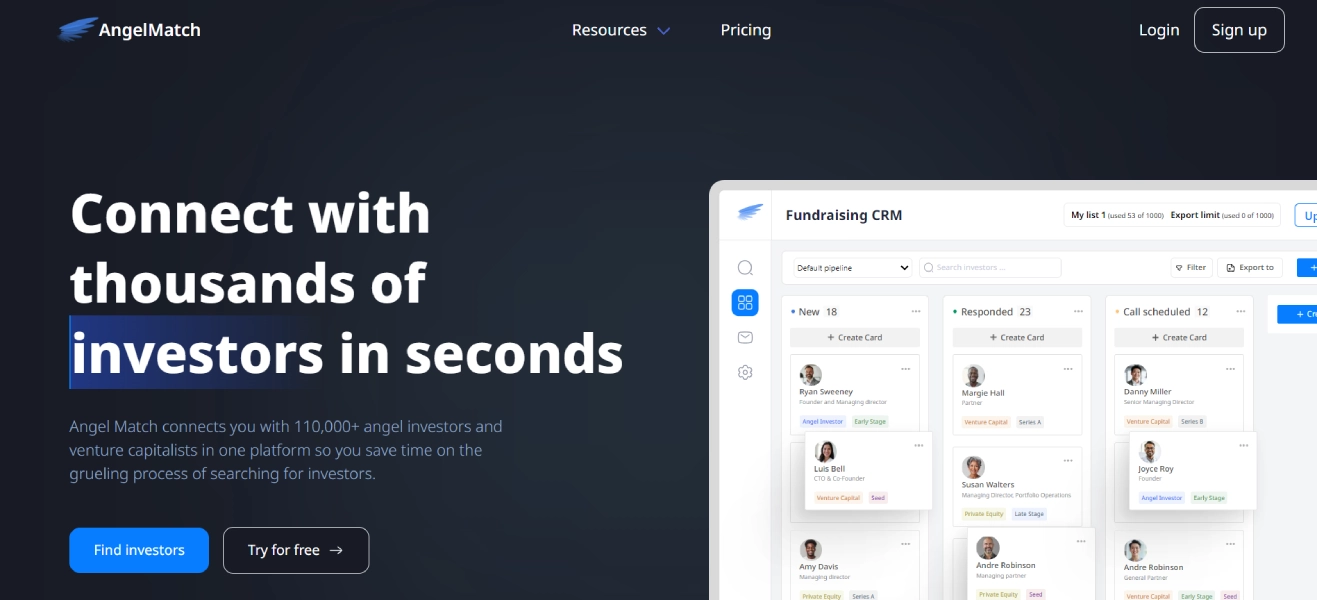

Angel Match: Your Shortcut to the Right Investors

Angel Match is a powerhouse database with over 110,000 angel investors and VCs, including 70,000+ with verified email addresses. Launched to simplify the investor hunt, it’s helped startups in niches like transportation and medtech secure pre-seed and seed funding by connecting them with investors who align with their industry and goals. Think of it as a smart matchmaker that cuts through the noise, saving you hours of research and helping you focus on building your business.

Here’s what makes Angel Match stand out:

- Smart Matching System: Angel Match’s filtering tools let you zero in on investors by location, industry, investment stage, or preferences. Need angels who fund early-stage AI startups in Austin? Customize your search and get a tailored list in seconds.

- Detailed Investor Profiles: Each profile is a goldmine—emails, social media, past investments, and investment interests. This helps you craft personalized pitches that resonate, increasing your chances of a response. Founders rave about how these insights make outreach feel less like a shot in the dark.

- Engagement Tracking: Manage your investor interactions in one place. Track who’s opened your emails, organize leads, and build a personalized database to streamline your fundraising. One founder said Angel Match “saved us significant time” by connecting them with niche transportation investors.

- Time-Saving Efficiency: With 110,000+ investors at your fingertips, you skip the endless Google searches. The platform’s design lets you focus on pitching, not prospecting.

Angels Partners: Your Fast-Track to Investor Connections

Angels Partners is a database of over 120,000 investors, including 40,000 business angels, 69,000 VCs, and family offices. Since its launch, it’s facilitated over 100,000 connections between founders and investors, helping startups like The MVMNT Group raise $250,000 in weeks for their SaaS product.

This platform’s mission is to get your pitch in front of the right investors, saving you months of outreach grind.

💡Want To Know: How to Raise Your First Round

Here’s what sets Angels Partners apart:

- Massive Investor Database: Access 120,000+ investors and filter by industry, deal size, location, or stage. Looking for angels who fund pre-seed SaaS in London? You’ll get a tailored list in minutes, complete with contact details.

- Smart Outreach Tools: Send personalized cold emails with high-conversion templates created by ex-VCs. Track opens, clicks, and responses to gauge investor interest. Founders report an 80% higher response rate with these tools.

- Community Connections: Join a network of 400+ founders and 300+ active investors. Swap intros with other founders in your industry or get warm LinkedIn introductions through their plugin, which scans your network for investor connections.

- Fundraising CRM: Manage your outreach like a pro with automated follow-ups and document tracking. See who’s viewed your deck and prioritize hot leads. One founder said it “cut our fundraising time in half.”

Evalyze.ai: Your AI-Powered Fundraising Ally

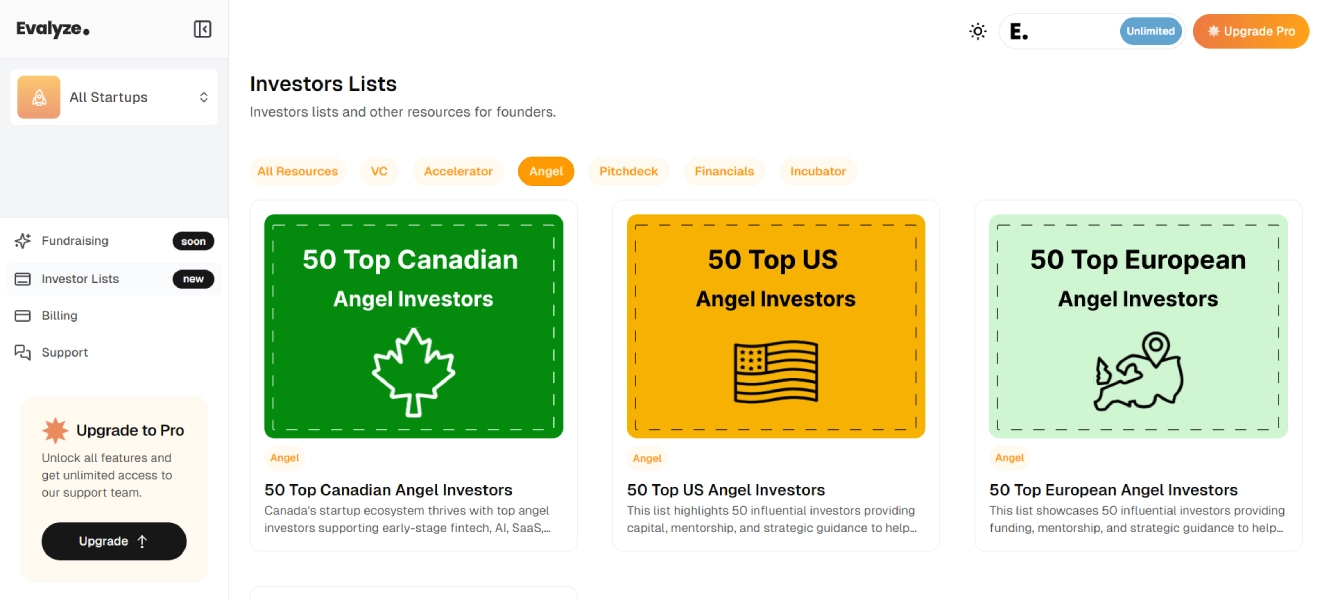

Evalyze.ai leverages AI to help startups raise funds faster, used by over 1,000 startups to connect with investors. It offers curated lists by region, focusing on early-stage sectors.

Beyond lists, Evalyze.ai analyzes your pitch deck, provides actionable improvements, and helps you access investors in minutes, not days. It’s built on tech from OpenAI, Y Combinator, AWS, and Vercel, ensuring a seamless experience.

Here’s what makes Evalyze.ai stand out:

- Curated Investor Lists: Access targeted lists of top angel investors by region—Canada, US, Europe, and Middle East, with details on their investment focus.

- AI Pitch Deck Analysis: Upload your deck and get instant feedback to boost its impact. Founders report an 83% improvement in pitch quality, making investors take notice.

- Resource Filters: Narrow down investors by type (VC, accelerator, angel) or resource (pitch deck tips, financials). It’s all about saving you time while maximizing results.

- Free Starter Plan: Get started for free and upgrade to their Pro plan for premium features and access to fundraising resources.

Learn the key elements that make a pitch deck stand out by reading our guide on How to Create an Unignorable Startup Pitch Deck.

Take Your First Steps Toward Fundraising

If you’re serious about getting the right angel investors onboard, Evalyze.ai provides the tools to make it happen. Skip the guesswork, access tailored investor lists, use AI for fundraising, and connect with investors who match your startup’s needs.

More Articles

Use AI for Fundraising

Artificial intelligence (AI) is transforming fundraising by making it more efficient, precise, and innovative

January 16, 2025

15 Company’s pitch decks raised millions of dollars + Pitch Deck ppts Links

Evaluating a company's pitch deck is a critical part of assessing its potential for raising capital and long-term success. This blog post of Evalyze.ai will showcase 15 standout companies whose pitch decks helped secure millions of dollars in funding, fueling their growth and market impact. From innovative tech platforms to sustainable brands, each of these companies used a compelling pitch to connect with investors. We also provide downloadable links to their pitch decks, giving you a behind-the-scenes look at what it takes to create a winning presentation for potential backers.

December 23, 2024